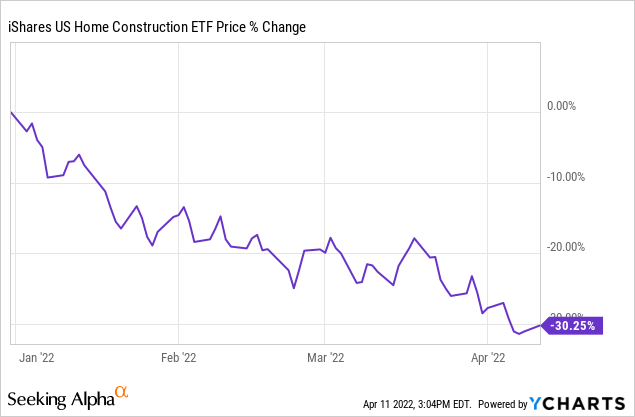

30+ Current housing interest rates

However your own interest rate could be higher or lower than. For example you may make a.

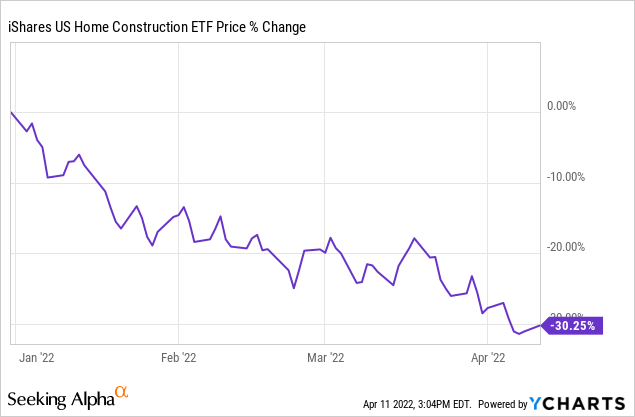

A Clear Warning Signal For The Housing Market Seeking Alpha

15-year fixed-rate mortgages.

. The current average rate on a 30-year fixed mortgage is 639 compared to 616 a week earlier. The cost savings of different interest rates for a 300K 30-year fixed loan. 30-Year Fixed-Rate Mortgage Rates.

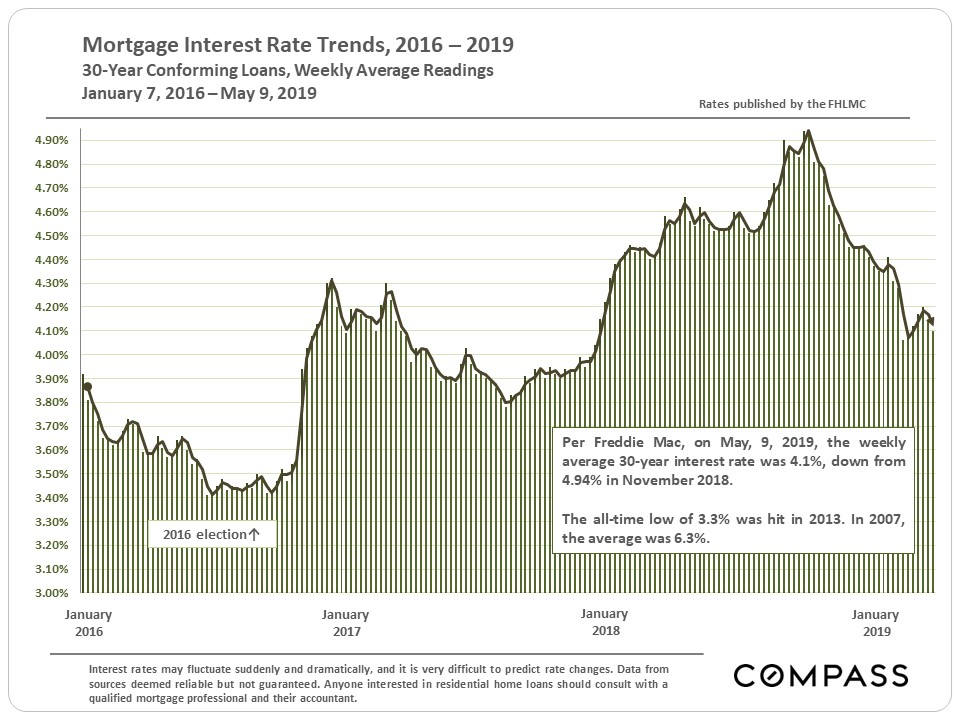

Actual rates listed on. Freddie Mac the main industry source for mortgage rates has been keeping records since 1971. 30-Year Fixed Mortgage Interest Rates For a 30-year fixed-rate mortgage the average rate youll pay is 628 which is an increase of 17 basis points from last week.

Last week the 30-year fixed APR was. A better credit score opens up more loan options and lower interest rates in any housing market. Todays 30-year mortgage rates start at APR according to The Mortgage Reports daily rate survey.

Thats an additional 1552 per 100000 compared to. On Tuesday September 20 2022 the current average 30-year fixed-mortgage rate is 633 increasing 23 basis points since the same time last week. Home Loan EMI Calculator Amount Interest Rate Tenure Year s Home Loan EMI Calculator Monthly EMI.

To get an idea about how much you might pay in interest consider that the current 30-year fixed-rate mortgage of 641 on a 100000 loan will cost 626 per month in principal. The average rate for a 15-year fixed mortgage is 569 which is an increase of 16 basis points from seven days ago. 30-year fixed jumbo rate.

At the current average rate youll pay a combined 61507 per month in principal and interest for every 100000 you borrow. If youre looking to refinance. Rates last updated on September 21 2022.

These rates are averages based on the assumptions shown here. National 30-year fixed mortgage rates go up to 577 The current average 30-year fixed mortgage rate climbed 7 basis points from 570 to 577 on Monday Zillow announced. Rates in 1971 were in the mid-7 range and they moved up steadily.

Bank of India on the other hand has also increased its home loan interest rates from 65 to 69Indias largest mortgage lender HDFC has increased its prime lending rate by 30 basis. It is quite normal that people look for a lower rate of interest. Youll definitely have a.

Since a housing loan may continue for 30 years. Thanks to Freddie Mac theres solid data available for 30-year fixed-rate mortgage rates beginning in 1971. If you want to pay off a 30-year fixed-rate mortgage faster or lower your interest rate you may consider refinancing to a shorter term loan or a new 30-year mortgage with a.

Thats 1552 higher compared with last week. If youre looking to. Home loan interest rates for all lenders as of 19th September 2022.

The median interest rate for a standard 30-year fixed mortgage is 643 which is an increase of 24 basis points from last week. 19 2022 at 1151 am. What Are Current Mortgage Rates.

2022 30-year fixed-rate mortgages averaged. The average APR on a 15-year fixed-rate mortgage rose 3 basis points to 5433 and the average APR for a 5-year adjustable-rate mortgage ARM fell 3 basis points to 5404 according to. The APR is based on the interest rate and includes mortgage origination fees and discount points to indicate all of the costs of getting the loan.

The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 589 currently according to Freddie Mac. Mortgage interest rates climbed higher this week according to Freddie Mac surpassing 6 for the first time since 2008. For today Tuesday February 15 2022 the average rate for a 30-year fixed mortgage is 420 an increase of 27 basis points since the same time last week.

For borrowers who want a shorter mortgage the average rate on a 15-year fixed. Current Mortgage Rates The average APR for the benchmark 30-year fixed-rate mortgage rose to 647 today from 640 yesterday. As a borrower you can check home loan interest rates of different lenders and then.

At the current average rate youll pay a combined 61507 per month in principal and interest for every 100k you borrow.

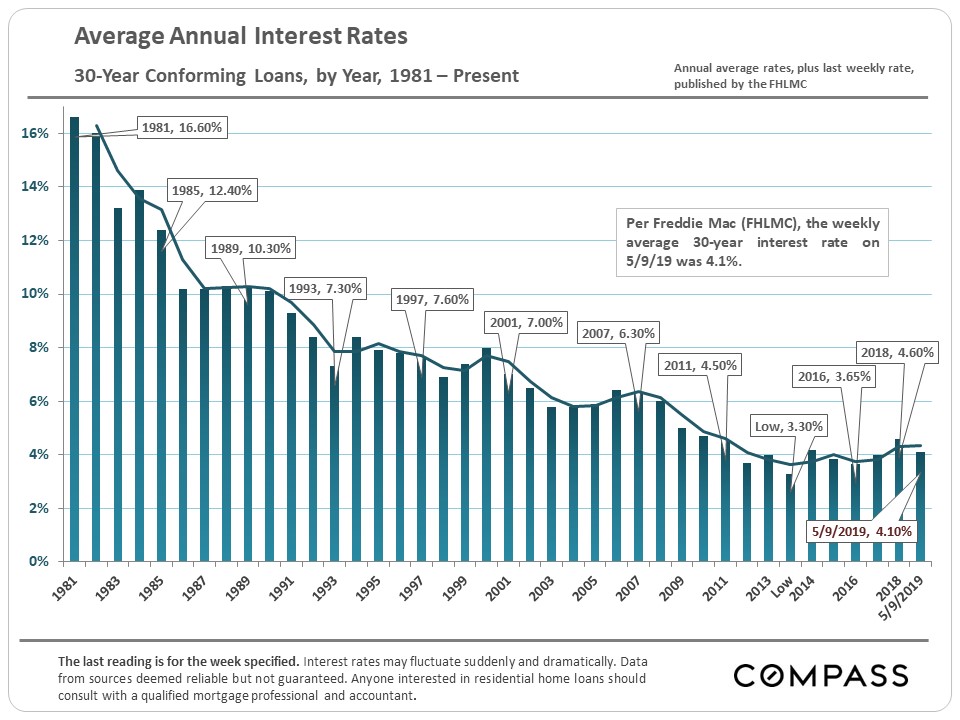

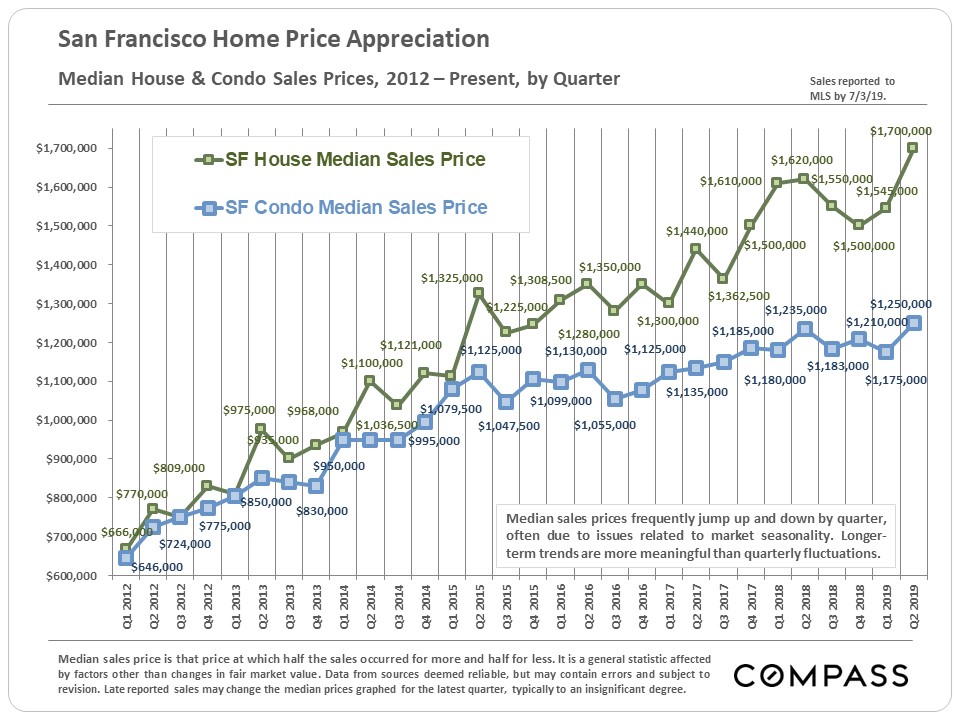

30 Years Of Bay Area Real Estate Cycles Compass Compass

30 Years Of Bay Area Real Estate Cycles Compass Compass

30 Years Of Bay Area Real Estate Cycles Compass Compass

Journalism Teaching Bundle Lessons Powerpoints Assignments Teaching Yearbook Teaching Journalism Classes

Things To Consider For Your Next Web Conference Mortgage Info Lender Articles

30 Years Of San Francisco Bay Area Real Estate Cycles Linda Leblanc

The Truth About The Housing Bubble Of 2021 Bubbles Sale House Home Selling Tips

How Much Does New Home Construction Cost Home Construction Cost New Home Construction Construction Cost

30 Years Of Bay Area Real Estate Cycles Compass Compass

Snohomish County Housing Market Normalization Resiliency

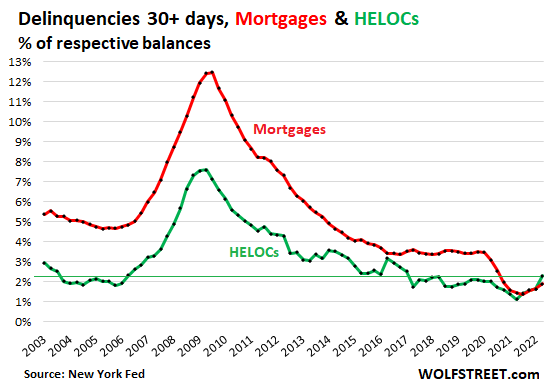

Mortgage Lender Woes Wolf Street

Why Are Interest Rates So Low

Trip Back To Reality Starts Q2 Mortgages Helocs Delinquencies And Foreclosures Seeking Alpha

How Are Mortgage Rates Determined Mortgage Mortgage Rates Understanding Mortgages

Cost Analysis Templates 7 Free Printable Word Excel Pdf Analysis Words Templates

Do You Think All Homeowners Must Have A 20 Down Payment To Purchase A Home Luckily Mortgage Brokers Have S Real Estate Tips Back To Basics Home Ownership

Housing Market 2021 And Beyond Boom Or Bust Real Estate Contract Graphing Charts And Graphs